QuickLinks-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

Information Required In Proxy Statement

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (AMENDMENT NO.(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material | |

Duke Energy Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

Proxy Statement | |

and notice of 2005 Annual Meeting |

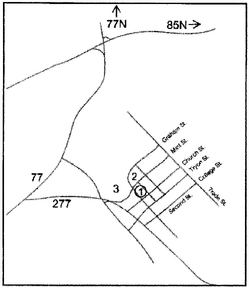

| 526 South Church Street Charlotte, NC 28202-1802 |

March 27, 2002

31, 2005

Dear Shareholder:

I am pleased to invite you to our annual meeting to be held on April 25, 2002May 12, 2005, in the O. J. Miller Auditorium located in our Charlotte headquarters building. We will discuss our 20012004 performance and our goals for 2002,2005 and respond to any questions you may have. Enclosed with this proxy statement are your proxy card, voting instructions, Duke Energy's 2004 Summary Annual Report and Duke Energy's 2001 annual report.

Within the proxy statement you will see that the Board of Directors has

proposed for your approval certain amendments to our Articles of Incorporation.

These proposed changes are designed to modernize this important document and

bring it in line with those of many of our peer companies. On behalf of the

Board of Directors, I urge your support for these important proposals.

2004 Form 10-K.

As in the past, we are offering you the opportunity to cast your vote by telephone or online via the Internet. Whether you choose to vote by proxy card, telephone or Internet, it would help if you would vote as soon as possible.

I look forward to seeing you at the annual meeting.

Sincerely,

/s/ R.B. Priory

R.B. PRIORY

![]()

Paul M. Anderson

Chairman of the Board President

and Chief Executive Officer

[LOGO] Duke Energy (R)

526 South Church

Street

Charlotte, NC

28202-1802

| 526 South Church Street Charlotte, NC 28202-1802 |

Notice of Annual Meeting of Shareholders

April 25, 2002

March 27, 2002

May 12, 2005

| March 31, 2005 | |||

We will hold the annual meeting of shareholders of Duke Energy Corporation on Thursday, May 12, 2005, at 10:00 a.m. in the O. J. Miller Auditorium in the Energy Center located at 526 South Church Street in Charlotte, North Carolina. | |||

The purpose of the annual meeting is to consider and take action on the following: | |||

1. | Election of three nominees as Class II directors and one nominee as Class III director. | ||

| 2. | Approval of amendments to Duke Energy's Restated Articles of Incorporation to eliminate classification of Duke Energy's Board of Directors. | ||

| 3. | Ratification of Deloitte & Touche LLP as Duke Energy's independent auditor for 2005. | ||

Shareholders of record as of March 14, 2005, can vote at the annual meeting. This proxy statement, proxy card and voting instructions, along with our 2004 Summary Annual Report and 2004 Form 10-K, are being distributed on or about March 31, 2005. | |||

Your vote is very important. If voting by mail, please sign, date and return the enclosed proxy card in the enclosed prepaid envelope and allow sufficient time for the postal service to deliver your proxy before the meeting. If voting by telephone or on the Internet, please follow the instructions on your proxy card. | |||

By order of the Board of Directors. | |||

B. Keith Trent Acting Group Vice President, General Counsel and Secretary | |||

Table of Contents

| Commonly Asked Questions and Answers About the Annual Meeting | 1 | ||||

Proposals to be Voted Upon | |||||

Proposal 1: | Election of Directors | 3 | |||

Proposal 2: | Approval of Amendments to Duke Energy's Restated Articles of Incorporation to Eliminate Classification of Duke Energy's Board of Directors | 3 | |||

Proposal 3: | Ratification of Deloitte & Touche LLP as Duke Energy's Independent Auditor for 2005 | 4 | |||

The Board of Directors | 5 | ||||

Beneficial Ownership | 9 | ||||

Information on the Board of Directors | 11 | ||||

Report of the Audit Committee | 18 | ||||

Report of the Compensation Committee | 19 | ||||

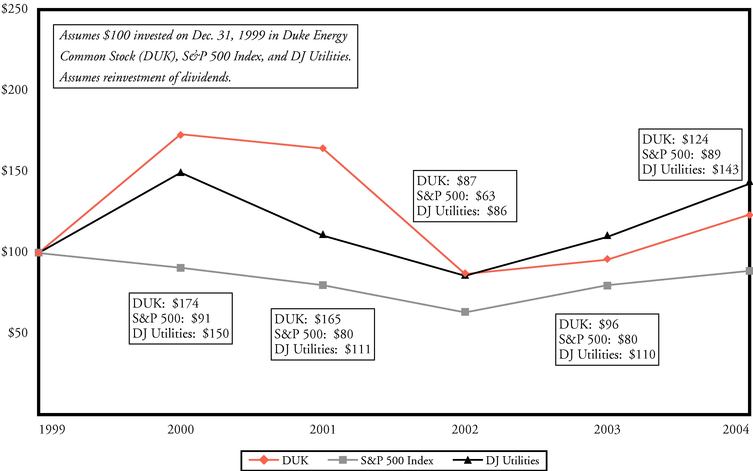

Performance Graph | 24 | ||||

Executive Compensation | 25 | ||||

Summary Compensation Table | 25 | ||||

Option/SAR Grants in 2004 | 28 | ||||

Option Exercises and Year-End Values | 28 | ||||

Long-Term Incentive Plan—Awards in Last Fiscal Year | 29 | ||||

Employment Contracts and Termination of Employment and Change-in-Control Arrangements | 30 | ||||

Retirement Plan Information | 33 | ||||

Other Information | 35 | ||||

Appendix A — | Declassification Amendment to the Restated Articles of Incorporation of Duke Energy Corporation | A-1 | ||

Appendix B — | Charter of the Audit Committee | B-1 |

Commonly Asked

Questions and

Answers About the annual meeting of shareholders of Duke Energy Corporation on

Thursday,

April 25, 2002, at 10:00 a.m. in the O. J. Miller Auditorium in the Energy

Center located at

526 South Church Street in Charlotte, North Carolina.

The purpose of the annual meeting is to consider and take action on the

following:

1.

Annual Meeting

- Q:

- What am I voting on?

- A:

- •

- Election of four directors: the nominees

asare Roger Agnelli, G. Alex Bernhardt, Sr., and Dennis R. Hendrix for Class IIdirectorsandone nominee as aA. Max Lennon for ClassI director. 2.III; - •

- Approval of amendments to Duke Energy's Restated Articles of Incorporation to eliminate classification of Duke Energy's Board of Directors; and

- •

- Ratification of Deloitte & Touche LLP as Duke Energy's independent

auditorsauditor for2002. Amendment to the Articles of Incorporation to: 3A. Update the corporate purpose clause. 3B. Authorize serial preferred stock. 3C. Increase the shareholder vote required to change the By-Laws. 3D. Decrease the permissible range of size of the Board of Directors. 4. A shareholder proposal relating to investments in alternative energy sources, if properly presented at the annual meeting. 5. A shareholder proposal relating to the role of the Board of Directors in long-term strategic planning, if properly presented at the annual meeting. 6. A shareholder proposal relating to the appointment of independent auditors who only render audit services, if properly presented at the annual meeting. 7. A shareholder proposal relating to a study of the risk and responsibility for public harm due to Duke Energy's nuclear program, if properly presented at the annual meeting. Shareholders of record as of February 28, 2002 can vote at the annual meeting. This proxy statement, proxy card and voting instructions, along with our 2001 annual report to shareholders, are being distributed on or about March 27, 2002. Your vote is very important. If voting by mail, please sign, date and return the enclosed proxy card in the enclosed prepaid envelope, and allow sufficient time for the postal service to deliver your proxy before the meeting. If voting by telephone or on the Internet, please follow the instructions on your proxy card. By order of the Board of Directors /s/ Richard W. Blackburn Richard W. Blackburn Executive Vice President, General Counsel and SecretaryTable of Contents - --------------------------------------------------------------------------------Commonly Asked Questions and Answers About the Annual Meeting......................... 1 Proposals to be Voted Upon Proposal 1: Election of Directors................................................ 3 Proposal 2: Ratification of Deloitte & Touche LLP as Duke Energy's Independent Auditors for 2002............................. 3 Amendment to the Articles of Incorporation to: Proposal 3A: Update the Corporate Purpose Clause................................. 3 Proposal 3B: Authorize Serial Preferred Stock.................................... 4 Proposal 3C: Increase the Shareholder Vote Required to Change the By-Laws........ 6 Proposal 3D: Decrease the Permissible Range of Size of the Board of Directors.... 7 Shareholder Proposals: Proposal 4: Investments in Alternative Energy Sources............................ 7 Proposal 5: Role of the Board of Directors in Long-Term Strategic Planning....... 8 Proposal 6: Appointment of Independent Auditors Who Only Render Audit Services... 9 Proposal 7: Study of the Risk and Responsibility for Public Harm Due to Duke Energy's Nuclear Program................................................ 11 The Board of Directors................................................................ 13 Beneficial Ownership.................................................................. 17 Information on the Board of Directors................................................. 18 Report of the Audit Committee......................................................... 20 Report of the Compensation Committee.................................................. 21 Performance Graph..................................................................... 24 Compensation Summary Compensation Table........................................................ 25 Option Grants in 2001............................................................. 27 Option Exercises and Year-End Values.............................................. 28 Employment Contracts and Termination of Employment and Change-in-Control Arrangements.................................................................... 29 Retirement Plan Information....................................................... 30 Other Information..................................................................... 31 Exhibit A - Extract from the Articles of Incorporation of Duke Energy Corporation showing proposed amendments to Article IV.............................. A-1 Exhibit B - Extract from the Articles of Incorporation of Duke Energy Corporation showing proposed amendment to Article VII.............................. B-1Commonly Asked Questions and Answers About the Annual Meeting - --------------------------------------------------------------------------------2005.

- Q:

What am I voting on? A: . Election of five directors: the nominees are G. Alex Bernhardt, Sr., William A. Coley, Max Lennon, Leo E. Linbeck, Jr. and James T. Rhodes; . Ratification of Deloitte & Touche LLP as Duke Energy's independent auditors for 2002; . Amendment to the Articles of Incorporation to: . Update the corporate purpose clause; . Authorize serial preferred stock; . Increase the shareholder vote required to change the By-Laws; . Decrease the permissible range of size of the Board of Directors; . Shareholder proposals, if properly presented at the annual meeting, relating to: . Investments in alternative energy sources; . The role of the Board of Directors in long-term strategic planning; . The appointment of independent auditors who only render audit services; and . A study of the risk and responsibility for public harm due to Duke Energy's nuclear program. Q: - Who can vote?

- A:

Common shareholders - Holders of Duke Energy Common Stock as of the close of business on the record date,

February 28, 2002,March 14, 2005, can vote at the annual meeting, either in person or by proxy. Each share of Duke Energy Common Stock has one vote. - Q:

- How do I vote?

- A:

- Sign and date each proxy card that you receive and return it in the prepaid envelope or vote by telephone or on the Internet. If we receive your signed proxy card (or properly transmitted telephone or Internet proxy) before the annual meeting, we will vote your shares as you direct. You can specify when submitting your proxy whether your shares should be voted for all, some or none of the nominees for director. You can also specify whether you approve, disapprove or abstain from voting on the other

9two proposals. - If you use the proxy card and simply sign, date and return it without making any selections, your proxy will be voted in accordance with the recommendations of the Board of Directors:

.- •

- infavor of the election of the nominees for director named in Proposal 1;

. - •

- infavor of

Proposals 2, 3A, 3B, 3CProposal 2; and3D; and . against Proposals 4, 5, 6 and 7. - •

- infavor of Proposal 3.

- Q:

- May I change my vote?

- A:

- You may change your vote or revoke your proxy by:

.- •

- casting another vote either in person at the meeting or by one of the other methods discussed above; or

. - •

- notifying the Corporate Secretary, in care of the Investor Relations Department, at Post Office Box 1005, Charlotte, NC

28201-1005.28201-1005 prior to the close of business on May 11, 2005.

- Q:

- Can I vote my shares by telephone or on the Internet?

- A:

If you hold your shares in your own name, you - Yes. You may vote by telephone or on the Internet, by following the instructions included on your proxy card. Your deadline for voting by telephone or on the Internet is 11:59 p.m.,

April 23, 2002. If your shares are held in "street name" (in a brokerage account, for example), you will need to contact your broker or other nominee holder to find out whether you will be able to vote by telephone or on the Internet.May 10, 2005. - Q:

- Will my shares be voted if I do not provide my proxy?

- A:

No. - It depends on whether you hold your shares in your own name or in the name of a brokerage firm. If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy unless you vote in person at the meeting. Brokerage firms generally have the authority to vote customers' unvoted shares on certain "routine" matters. If your shares are held in the name of a brokerage firm, the brokerage firm can vote your shares for the election of directors and for Proposals 2

3Aand3D (but not the other proposals)3 if you do not timely provide your proxy because these matters are considered "routine" under the applicable rules. - Q:

- As a participant in the Duke Energy

employee,Retirement Savings Plan, how do I vote shares held in myaccount in the Duke Energy Retirement Savings Plan?plan account? - A:

- If you are a participant in the Duke Energy Retirement Savings Plan, you have the right to

directprovide voting directions to thePlanplan trustee,in the voting ofby submitting your proxy card, for those shares of Duke Energy Common Stock that are held by thePlanplan and allocated to yourPlanplan account on any issues presented at the annual meeting. Plan participant proxies will be treated confidentially.

If you elect not to vote by proxy,provide voting directions to the plan trustee, shares allocated to your Planplan account willare to be voted by the Planplan trustee in the same proportion as those shares held by the Planplan for which the Planplan trustee has received directionvoting directions from Planplan participants. 1

Commonly Asked QuestionsThe plan trustee will follow participants' voting directions, and Answers About the Annual Meeting

- --------------------------------------------------------------------------------

plan procedure for voting in the absence of voting directions, unless it determines that to do so would be contrary to its fiduciary responsibility.

- Q:

- What constitutes a quorum?

- A:

- As of the record date,

February 28, 2002, 778,199,474March 14, 2005, 957,948,926 shares of Duke Energy Common Stock were issued and outstanding and entitled to vote at the

Commonly Asked

Questions and

Answers About the

Annual Meeting

- meeting. In order to conduct the annual meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a "quorum." If you submit a properly executed proxy card or vote by telephone or on the Internet, you will be considered part of the quorum. Abstentions and broker "non-votes" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

- Q:

- What vote is needed for these proposals to be adopted?

- A:

- Directors are elected by a plurality of the votes cast at the meeting. "Plurality" means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. In order for Proposal 2 to take effect, it must be approved by holders of at least 80% of the voting power of outstanding Duke Energy Common Stock. A majority of the votes cast at the meeting is required to approve

the other proposals, except that 80% of the Common Stock outstanding on February 28, 2002 is required to approveProposal3D.3. For the election of directors, abstentions and broker "non-votes" will not be counted. Forthe other proposals,Proposals 2 and 3, abstentions and broker "non-votes" will not be counted as votes cast. - Q:

- Who conducts the proxy solicitation and how much will it cost?

- A:

- Duke Energy is asking for your proxy for the annual meeting and will pay all the costs of asking for shareholder proxies. We have hired Georgeson Shareholder Communications, Inc. to help us send out the proxy materials and ask for proxies. Georgeson's fee for these services is

$22,500,$17,500 plus out-of-pocket expenses. We can ask for proxies through the mail or personally by telephone, telegram, fax or other means. We can use directors, officers and regular employees of Duke Energy to ask for proxies. These people do not receive additional compensation for these services. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Duke Energy Common Stock. - Q:

- How does a shareholder nominate someone to be a director of Duke Energy or bring business before the annual meeting?

- A:

- Nominations for director may be made only by the Board of Directors or by a shareholder who has given the proper notice, as provided in the By-Laws, as amended, of such shareholder's intention to appear in person at the annual meeting and nominate a candidate for director. Pursuant to the By-Laws, as amended, such notice must be given between 90 and 120 days prior to the first anniversary of the previous year's annual meeting. For the

20032006 annual meeting, we must receive this notice on or afterDecember 26, 2002,January 12, 2006, and on or beforeJanuary 25, 2003.February 11, 2006. - Such notice and nomination should be submitted in writing to the Corporate Secretary, Duke Energy Corporation, P. O. Box 1006, Charlotte, NC 28201-1006 within the specified time limits and should include the information required for shareholder nominations as set forth under the caption "Corporate Governance Committee and Nomination of Directors" under "Information on the Board of Directors" below in this proxy statement. Nominations properly made by shareholders are also considered by the Corporate Governance Committee for possible recommendation to the Board of Directors, which determines which nominees to recommend for election by the shareholders.

- Other business may be brought before an annual meeting by a shareholder who has delivered notice (containing certain information specified in the By-Laws) within the time limits described above for delivering notice of a nomination for the election of a director. These requirements apply to any matter that a shareholder wishes to raise at an annual meeting other than through the

SEC'sSecurities and Exchange Commission's shareholder proposal procedures. If you intend to use theSECSecurities and Exchange Commission procedures and wish to have your proposal included in next year's proxy statement, you must deliver the proposal in writing to our Corporate Secretary byNovember 27, 2002.December 1, 2005. - A copy of the full text of the By-Law advance notice provisions discussed above may be obtained by writing to the Office of the Corporate Secretary, Post Office Box 1006, Charlotte, North Carolina 28201-1006.

2

Proposals to be

Voted Upon

- --------------------------------------------------------------------------------

PROPOSAL 1:

Election of Directors

The Board of Directors recommends a vote FOR each nominee.

The Board of Directors of Duke Energy currently consists of 12 members,13 members. Two directors, Robert J. Brown and Leo E. Linbeck, Jr., will be retiring at the 2005 annual meeting pursuant to Duke Energy's Board of Directors retirement policy, and one director, George Dean Johnson, Jr., has notified Duke Energy that he will be resigning at the 2005 annual meeting. These three directors have served Duke Energy for many years, and Duke Energy thanks them for their years of service. Following the 2005 annual meeting, the Board will consist of 10 members. However, as discussed below under the caption "Corporate Governance Committee and Nomination of Directors" under "Information on the Board of Directors," the Corporate Governance Committee has recently recommended to the Board of Directors the appointment of James H. Hance, Jr., the recently retired vice chairman of Bank of America Corporation, as a director upon the receipt of a required regulatory approval, which is not expected prior to the 2005 annual meeting. The Board of Directors will consider the appointment of Mr. Hance only after the regulatory approval is obtained, and thus Mr. Hance's nomination is not being submitted to the shareholders for election at the 2005 annual meeting. If appointed, Mr. Hance will stand for election by the shareholders at the 2006 annual meeting.

The Board of Directors is divided into three classes. The three-year terms of the classes are staggered so that the term of one class expires at each annual meeting. The terms of the four Class II directors will expire at the 20022005 annual meeting. In addition, James T.

Rhodes,meeting, including Roger Agnelli, who was appointed as a Class III director by the Board of Directors on October 30, 2001, will stand for election atAugust 24, 2004, and effective November 19, 2004, and Dennis R. Hendrix, who was appointed as a Class II director by the 2002 annual meeting. If

elected, his term will expire atBoard of Directors on December 16, 2004. Mr. Agnelli and Mr. Hendrix were recommended to the 2004 annual meeting.

Corporate Governance Committee by Duke Energy's Chief Executive Officer and by nonmanagement directors, respectively.

The Board of Directors has nominated the following Class II directors for election:

Roger Agnelli, G. Alex Bernhardt, Sr., Williamand Dennis R. Hendrix, as Class II directors; and A. Coley, Max Lennon and Leo E.

Linbeck, Jr. It has nominated James T. Rhodes for election as a Class IIII director.

The terms of the Class II directors elected at the 2005 annual meeting will expire in 2008. The term of the Class III director elected at the 2005 annual meeting will expire in 2006.

If any director is unable to stand for election, the Board of Directors may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve.

As part

PROPOSAL 2:

Approval of our agreementAmendments to acquire Westcoast Energy Inc.,Duke Energy's Restated Articles of Incorporation to Eliminate Classification of Duke Energy's Board of Directors.

The Board of Directors recommends a vote FOR this proposal.

The Board of Directors has unanimously approved, and recommends that the shareholders approve, amendments to Duke Energy's Restated Articles of Incorporation to declassify the Board of Directors agreedand to appoint Michael E.J. Phelps, Westcoast's Chief Executive

Officer, as a directorprovide for annual election of Duke Energy following consummationdirectors.

Article VIII of the transaction. Since such consummation did not occur in sufficient time to permitRestated Articles of Incorporation currently provides for the Board of Directors to nominate Mr. Phelps and have him includedbe divided into three classes, as nearly equal in this

proxy statementnumber as a nominee for election to the Board of Directors, he will be

appointed as a director in Class I at the next regular meetingpossible, with each class serving staggered three-year terms. The classification of the Board of Directors was adopted by amendment to the Restated Articles of Incorporation in 1991 following the consummationapproval of the Westcoast acquisition.amendment by holders of over 80% of the then-outstanding Duke Energy Common Stock. Classification is intended to preserve the continuity and experience of Board members and to allow Duke Energy a level of protection against unfair treatment in takeover situations by eliminating the threat of abrupt removal and making it more difficult and time consuming to take control of the Board of Directors.

Some shareholder groups believe that classified boards reduce accountability and responsiveness of the Board of Directors by eliminating the ability to evaluate and elect all directors each year. A shareholder proposal seeking declassification of the Board of Directors was presented to shareholders at Duke Energy's 2004 annual meeting, and a majority of shareholders who voted on the proposal voted in favor of it.

Proposals to be

Voted Upon

Proposal 2 Continued

After careful consideration of the issue, and in light of the shareholders' approval of last year's declassification proposal, the Board of Directors has determined that it would be in the best interests of Duke Energy to eliminate classification of the Board. While the Board of Directors believes that the benefits of a classified board are important, the Board is committed to ensuring maximum accountability by the Board and by management to Duke Energy's shareholders, and annual elections of directors would provide shareholders with a means of evaluating each director each year.

In connection with declassification of the Board, the Board of Directors has also approved, and recommends that shareholders approve, an amendment to the Restated Articles of Incorporation that conforms the provision for the filling of vacancies to the declassification of the Board. The Board of Directors intendshas also approved conforming amendments to nominate Mr. PhelpsDuke Energy's By-Laws that would automatically take affect upon shareholder approval of Proposal 2. A copy of the proposed amendments to the Restated Articles of Incorporation is attached to this proxy statement as Appendix A.

If the shareholders approve Proposal 2, all directors, including those elected at this 2005 annual meeting of shareholders, would continue to serve the remainder of their terms, such that approximately one-third of the directors will stand for election toin 2006, approximately two-thirds of the directors will stand for election in 2007 and all directors will stand for election in 2008, with their successors being elected for one-year terms that expire at the next annual meeting. However, the Board of Directors has unanimously adopted a resolution that, if shareholders approve Proposal 2, encourages all directors whose terms continue past the 2006 annual meeting of shareholders to resign effective with the 2006 annual meeting, so that all directors would stand for election in 2006.

Approval of the amendments to the Articles of Incorporation requires the affirmative vote of holders of at least 80% of the 2003 annual meeting.

voting power of outstanding Duke Energy Common Stock.

PROPOSAL 2:

3:

Ratification of Deloitte & Touche LLP as Duke Energy's Independent AuditorsAuditor for 2002

2005

The Board of Directors recommends a vote FOR this proposal.

The Board of Directors upon recommendation ofconcurs with the reappointment, subject to shareholder ratification, by the Audit Committee has

reappointed, subject to shareholder ratification,of the firm of Deloitte & Touche LLP, certifieda registered public accountants,accounting firm, as independent auditors to examine Duke Energy's accounts for the year 2002.2005. If the shareholders do not ratify this appointment, the Board of DirectorsAudit Committee will consider other certifiedregistered public accountants upon recommendation of the Audit Committee.

accounting firms.

A representative of Deloitte & Touche LLP will as in prior years, attend the annual meeting and will have the opportunity to make a statement and be available to respond to appropriate questions.

PROPOSALS 3A through 3D:

Amendments to the Articles of Incorporation

While our Articles of Incorporation have been amended many times over the years

as the need arose, until recently no attempt has been made to determine whether

this document as a whole reflects modern corporate practices. As a result of a

recent analysis, the Board of Directors has determined that a number of

provisions contained in the Articles of Incorporation are either outmoded or no

longer necessary and recommends that the shareholders approve the adoption of

proposed amendments to those provisions as discussed below.

PROPOSAL 3A:

Updating of the Corporate Purpose Clause

The Board of

Directors recommends a vote FOR this proposal.

State law allows a corporation to state in its Articles of Incorporation the

purpose or purposes for which it is organized. The corporate purpose clause

currently set forth in Article III of our Articles of Incorporation was adopted

in 1917 and, consistent with the practice at that time, is very specific. While

augmented in later years and now of considerable length, it does not reflect

Duke Energy's current operations. The Board of Directors believes it would be

advisable to replace this outdated provision with a modern Article which states

that Duke Energy may engage in any lawful act or activity for which

corporations may be organized under the business corporation statute of North

Carolina, as amended from time to time. The proposed amendment is not intended

to change or otherwise affect Duke Energy's current business strategy. Rather,

it is standard language frequently used by North Carolina corporations and is a

desirable part of the set of proposals designed to modernize Duke Energy's

Articles of Incorporation.

3

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

PROPOSAL 3B:

Authorization of Serial Preferred Stock

The Board of Directors recommends a vote FOR this proposal.

Under Article IV of the Articles of Incorporation, Duke Energy is currently

authorized to issue 2,000,000,000 shares of Common Stock, without par value,

12,500,000 shares of Preferred Stock, $100 par value per share, 10,000,000

shares of Preferred Stock A, $25 par value per share, and 1,500,000 shares of

Preference Stock, $100 par value per share. As of February 28, 2002, there were

outstanding 778,199,474 shares of Common Stock, five series of Preferred Stock

without sinking fund requirements having an aggregate par value of

$178,000,000, two series of Preferred Stock with sinking fund requirements

having an aggregate par value of $38,000,000 and one series of Preferred Stock

A without sinking fund requirements having a par value of $31,000,000. There

were no shares of Preference Stock outstanding as of that date.

Reasons for the Proposed Amendment

The basic structure of Article IV relating to the issuance of the Preferred

Stock and the Preferred Stock A (Preferred Stocks) by series was adopted during

the 1950's based upon statutory authorization enacted many years earlier, and

has a number of features prevalent at that time that are no longer desirable.

These include a two-thirds class vote of the Preferred Stocks for issuances

exceeding 250,000 shares in the case of Preferred Stock or 1,000,000 shares in

the case of Preferred Stock A unless certain earnings and assets tests are met,

and for the approval of certain mergers and consolidations involving Duke

Energy regardless of size and whether or not Duke Energy is the surviving

corporation. Article IV also does not permit the Board of Directors to issue

series of the Preferred Stocks having general voting power.

The Board of Directors believes that it would be advisable to amend Article IV

to authorize a new class of Preferred Stock, to be known as "Serial Preferred

Stock," consisting of 20,000,000 shares issuable in series, which would provide

the flexibility needed to meet current requirements of the securities market or

the exigencies of negotiations for the acquisition of other corporations or

properties. The proposed Serial Preferred Stock would not be set aside for any

specific purpose, but would be subject to issuance in the discretion of the

Board of Directors from time to time for any proper corporate purpose without

further action by the shareholders. The terms of any new series will be

dependent largely on conditions existing at the time of issuance and therefore

cannot be indicated at the present time.

The Board of Directors has no immediate intention to enter into any

negotiations, agreements or understandings with respect to the proposed Serial

Preferred Stock, but considers it advisable and in the best interests of Duke

Energy to have such shares authorized and available for issuance to meet future

requirements if and when the need arises. Requiring the shareholders to meet

and approve each separate issuance of a series would be time-consuming and

costly, particularly in those instances where the number of shares to be issued

may be small in relation to the total capital of Duke Energy. Moreover, if

shareholder approval of such securities were postponed until a specific need

arose, the delay could, in some instances, deprive Duke Energy of opportunities

otherwise available.

If the shareholders approve the proposed amendment to Article IV, Duke Energy

will no longer issue any shares of Preferred Stock or Preferred Stock A and

anticipates that over time it will redeem or otherwise retire the outstanding

series of those classes of stock when it is deemed cost-efficient to do so and

otherwise advantageous under the circumstances. One of the outstanding series

of Preferred Stock with sinking fund requirements must be redeemed by Duke

Energy in December of this year, and the other outstanding series is

mandatorily redeemable in installments commencing in June 2003. By that time,

all outstanding series of Preferred Stock without sinking fund requirements

will be subject to redemption at the option of Duke Energy. The outstanding

series of Preferred Stock A without sinking fund requirements will be subject

to redemption at the option of Duke Energy commencing in December 2003.

The proposal of the Board of Directors contemplates that when all series of

Preferred Stock and Preferred Stock A are redeemed or otherwise retired, the

Articles of Incorporation will be amended, without further shareholder

authorization, to delete all references to the Preferred Stock and the

Preferred Stock A in Article IV of the Articles of Incorporation. At such time,

the Serial Preferred Stock, if and when issued, will become the senior equity

securities of Duke Energy.

4

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 3B continued

Proposed Serial Preferred Stock

The Serial Preferred Stock will rank junior to the Preferred Stock and the

Preferred Stock A and senior to the Preference Stock and the Common Stock with

respect to dividends and distribution of assets upon liquidation, dissolution

or winding up of Duke Energy.

The Board of Directors will be authorized to determine at the time of creating

each series the designations, preferences, limitations and relative rights of

the series permitted to be fixed by the Board of Directors pursuant to proposed

Article IV, including, but not limited to, the distinctive designation of and

the number of shares in the series, the terms of any dividend payable thereon,

the terms, if any, on which shares of the series may be redeemed, the terms of

any applicable sinking fund, any conversion or voting rights of the series and

the amount payable upon liquidation, dissolution or winding up of Duke Energy.

All shares of Serial Preferred Stock of the same series will be identical in

all respects and, except for the permitted variances and differences between

series expressly provided for in the resolutions creating the series as

contemplated by the proposed Article IV, all shares of Serial Preferred Stock

of all series will be identical in all respects.

Subject to the prior rights of the Preferred Stocks, each series of Serial

Preferred Stock with dividend rights will be entitled to receive, if declared

by the Board of Directors, and before any dividends are paid on the Preference

Stock or the Common Stock, dividends upon such terms as may be fixed by the

Board of Directors for such series.

Duke Energy will be permitted to redeem, pursuant to the provisions of any

applicable sinking fund or otherwise, any series of Serial Preferred Stock, or

any part thereof, upon such terms as the Board of Directors may fix at the time

it creates such series.

If so provided by the Board of Directors at the time of creation of the series,

the shares of a series of Serial Preferred Stock may be convertible or

exchangeable into shares of Common Stock or other securities of Duke Energy or

of any other corporation or other entity, upon terms fixed at the time of

creation of the series.

In the event of any voluntary or involuntary liquidation, dissolution or

winding up of Duke Energy, the holders of each series of Serial Preferred Stock

will be entitled to receive, subject to the prior payment in full of the

amounts payable in such event to the holders of the Preferred Stocks and before

any distribution is made to the holders of the Preference Stock or the Common

Stock, the distributive amount fixed by the Board of Directors at the time such

series was created.

The holders of the Serial Preferred Stock will have such voting rights as a

series or otherwise with respect to the election of directors or otherwise as

may be fixed by the Board of Directors at the time of the creation of the

series, in addition to any voting rights provided by law.

If so provided by the Board of Directors at the time of creation of the series,

the shares of a series of Serial Preferred Stock may be subject to restrictions

and conditions upon the issuance of any additional Serial Preferred Stock

ranking on a parity with or prior to such shares as to dividends or upon

dissolution.

The holders of the Serial Preferred Stock will have no preemptive rights. The

Serial Preferred Stock, when issued, will be fully paid and nonassessable.

The full text of the proposed Article IV of the Articles of Incorporation,

which includes the provisions for the proposed Serial Preferred Stock, is set

forth in Exhibit A to this proxy statement. The foregoing description of the

proposed Serial Preferred Stock is qualified in its entirety by reference to

such provisions.

Anti-Takeover Aspects

The Board of Directors has undertaken not to issue the Serial Preferred Stock

for the principal purpose of acting as an anti-takeover device and to seek

shareholder approval prior to authorizing the issuance of any Serial Preferred

Stock for that purpose.

Serial Preferred Stock can be, and has been, used by corporations specifically

for anti-takeover purposes. For example, shares of Serial Preferred Stock can

be privately placed with purchasers who support a board of directors in

opposing a tender offer or other hostile takeover bid, or can be issued to

dilute the stock ownership and voting power of a third party seeking a merger

or other extraordinary corporate transaction. Under these and similar

circumstances, the Serial Preferred Stock can serve to perpetuate incumbent

management and can adversely affect shareholders who may want to participate in

the tender offer or other transaction.

The Board of Directors is sensitive to these issues, particularly because Duke

Energy's Articles of Incorporation and By-Laws already contain provisions that

may have an anti-takeover effect. These provisions require, among other things,

(i) a classified Board of Directors, (ii) a vote of at least

5

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 3B continued

80% of Duke Energy's voting power to amend certain provisions of its Articles

of Incorporation, and (iii) advance notice procedures with respect to

shareholder proposals and nominations of directors. Duke Energy also has a

shareholder rights plan, the effect of which may be to discourage attempts to

gain control of Duke Energy without the approval of the Board of Directors. The

shareholder rights plan would not be affected by the proposed authorization of

shares of Serial Preferred Stock.

The proposal to amend Article IV is not part of a plan to adopt a series of

anti-takeover measures, and Duke Energy has no present intent to propose other

anti-takeover measures in future proxy solicitations. To emphasize this point,

the Board of Directors has adopted resolutions that state that the Serial

Preferred Stock authorized by the proposed amendment of Article IV:

a) not be used for the principal purpose of acting as an anti-takeover device

without shareholder approval; and

b) not be given supermajority voting rights except possibly with respect to

proposed amendments to the Articles of Incorporation altering materially

existing provisions of the Serial Preferred Stock or creating, or increasing

the authorized amount of, any class of stock ranking, as to dividend or

assets, prior to the Serial Preferred Stock.

--------

Unless required by North Carolina law, no further authorization for the

issuance of the Serial Preferred Stock would be necessary, but any such

issuance would be subject to the approval of the North Carolina Utilities

Commission and The Public Service Commission of South Carolina.

Financial Statements

A copy of the annual report to shareholders was mailed on or about March 27,

2002 to each shareholder of record on February 28, 2002. Reference is made to

the consolidated financial statements of Duke Energy, selected quarterly data

and management's discussion and analysis of results of operations and financial

condition, all appearing in such report, which are incorporated herein by this

reference. The consolidated financial statements of Duke Energy incorporated

herein have been examined by Deloitte & Touche LLP, independent auditors, to

the extent and for the periods indicated in their report thereon.

PROPOSAL 3C:

Requiring a Majority Vote of Holders of Outstanding Shares to Adopt, Amend or

Repeal the By-Laws

The Board of Directors recommends a vote FOR this proposal.

North Carolina law currently permits the shareholders to adopt, amend or repeal

the by-laws of a corporation at a meeting of the shareholders at which a

majority of the shares entitled to vote on the matter is present in person or

by proxy if the votes cast at the meeting favoring the action exceed the votes

cast at the meeting opposing the action. This could allow a minority (and in

certain circumstances a small minority) of the shareholders, without any

involvement by the board of directors of the corporation in the process, to

effect significant changes in a corporation's by-laws.

The Board of Directors believes that the By-Laws of Duke Energy, which,

together with its Articles of Incorporation, constitute its fundamental

governing documents, should be changed by the shareholders only when holders of

a majority of the outstanding shares entitled to vote on the matter favor such

change. Accordingly, the Board of Directors proposes to add a new Article VII

to the Articles of Incorporation, which would, as permitted by North Carolina

law, require the affirmative vote of the holders of at least a majority of the

combined voting power of the then outstanding shares of stock of all classes

entitled to vote generally in the election of directors, voting together as a

single class, for the shareholders to adopt, amend or repeal any provisions in

the By-Laws. This voting requirement would also apply to any amendment or

repeal of new Article VII of the Articles of Incorporation or the adoption of

any provision inconsistent with the new Article.

The full text of the proposed Article VII of the Articles of Incorporation,

which would replace current Article VII which is no longer required to be

included as part of the Articles of Incorporation, is set forth in Exhibit B to

this proxy statement.

6

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

PROPOSAL 3D:

Decrease the Permissible Range of Size of the Board of Directors

The Board of Directors recommends a vote FOR this proposal.

The By-Laws of Duke Energy have provided since 1986 that the number of

directors constituting the Board of Directors will be not less than twelve nor

more than twenty-four as fixed from time to time within those limits by the

Board of Directors. In that year the number of directors was fixed at twenty.

This By-Law provision was carried forward into the Articles of Incorporation of

Duke Energy in 1991 when certain amendments were made to that document. At that

time the number of directors was fixed at nineteen.

Consistent with modern governance principles, the Board of Directors has tended

in recent years to favor a smaller board as being more effective and has fixed

the number of directors at twelve, commencing with the date of the 2002 annual

meeting. The Board of Directors believes that the number of directors

constituting the Board of Directors should be not less than nine nor more than

eighteen, with the actual number of directors within that range continuing to

be fixed by the Board of Directors, and deems advisable a proposed amendment to

clause (a) of Article VIII of the Articles of Incorporation effecting this

change. The Board of Directors has made a corresponding change in the By-Laws,

subject to shareholder approval of the proposed amendment, to take effect on

the date of such approval.

SHAREHOLDER PROPOSALS

The following four proposals have been submitted by shareholders for inclusion

in this proxy statement. Upon oral or written request, we will promptly furnish

the names and addresses of the shareholders submitting the proposals, as well

as the number of shares they held at the time the proposals were submitted.

PROPOSAL 4:

Investments in Alternative Energy Sources

The Board of Directors recommends a vote AGAINST this shareholder proposal.

Invest in Clean Energy (I.C.E.) Proposal

Be it resolved that Duke Energy shall invest sufficient resources to build new

electrical generation from solar and wind power sources to replace

approximately one percent (1%) of system capacity yearly for the next twenty

years with the goal of having the company producing twenty percent (20%) of

generation capacity from clean renewable sources in 20 years.

Supporting Statement

Utility deregulation demands the company present a good public image, and the

public is demanding progress towards clean energy.

Efforts must be made to slow down changes in global climate so that we can

continue to survive on planet earth.

The proposal allows flexibility in schedule for the Board of Directors to

implement this proposal. The 20% figure is just a reasonable and conservative

goal to aim for.

A one percent yearly addition to generation capacity allows for small pilot

plants to be built and tried as the program advances.

The company should look to building facilities that are made to last a long

time.

Solar power towers, wind farms, solar photovoltaic arrays and parabolic solar

thermal collectors already exist in other places in this range of power

production, proving that Duke could realistically build such facilities in the

Carolinas and elsewhere.

Opposing Statement of the Board of Directors

A proposal identical to this proposal was submitted at last year's annual

meeting by one of the two shareholders making this proposal and was opposed by

over 95% of the shareholders voting at the meeting. The Board of Directors

believes that this proposal is contrary to the best interests of Duke Energy

and the shareholders.

Duke Energy considers the development of clean, renewable energy sources to be

a matter of importance. It also supports research in the development and

commercial deployment of such technologies and closely monitors technological

developments in this sector. Duke Energy has developed several different

commercial projects utilizing these kinds of technologies and participates in

commercial developments that are consistent with its business strategy and

capital investment requirements. As with other generation technologies deployed

by Duke Energy, renewable energy generation technologies must be economically

attractive in addition to their having technological feasibility.

The proponents would have shareholders require Duke Energy to pursue certain

renewable energy sources without reference to any economic, scientific or

technical data on which to evaluate such actions. If adopted, the proposal

would require Duke Energy to replace its electric generating system capacity

with solar and wind power sources by approximately 1% per year, regardless of

whether 1% replacements are practical and regardless of cost, and to commit to

that timetable for the next 20 years.

7

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 4 continued

The proposal generally requires Duke Energy to replace portions of its electric

generation system in artificial, predetermined percentage amounts according to

an artificial, predetermined timetable. Changes in the composition of electric

generation systems, however, do not occur in successive increments of

approximately 1% and are not implemented on the basis of the sort of timetable

that the proposal specifies. Moreover, the proposal could require Duke Energy

to dismantle system capacity that might be highly productive in order to

replace it with solar and wind power technologies, replacements that would

involve very substantial costs with respect to construction and maintenance.

Based on data provided by the World Energy Assessment conducted by the United

Nations Development Programme, the technologies included in the proposal

presently are 3 times to 40 times as expensive as current conventional

generation technologies.

The timing and advisability of entering into any new business, such as

renewables, including research and marketing decisions relating to it, require

the judgment of experienced management. Duke Energy has experience in renewable

energy. It has participated in past research and development and commercial

ventures involving renewable energy, including biomass and solar energy.

However, the long-term commitment and scale of investment required by the

proposal would not, in the Board's opinion, be in the best interests of

shareholders or customers.

The Board of Directors opposes this proposal because it requires Duke Energy to

adopt a highly restrictive and costly plan with respect to Duke Energy's future

electric operations. Duke Energy remains committed through research, technology

and innovation to meet consumers' demands for new products and services. Duke

Power, a Duke Energy company, is participating in a collaborative effort to

develop a voluntary green power program for North Carolina electric consumers.

The Board of Directors believes, however, that the requirement in the proposal

that Duke Energy should actively pursue a business activity such as renewable

energy sources, irrespective of consumers' demands, technical data and economic

factors, is unwarranted and not in the best interests of shareholders.

The Board of Directors recommends a vote AGAINST this proposal for the reasons

set forth above.

PROPOSAL 5:

Role of the Board of Directors in Long-Term Strategic Planning

The Board of Directors recommends a vote AGAINST this shareholder proposal.

Resolved, that the shareowners of Duke Energy Corporation ("Company") hereby

urge that the Board of Directors prepare a description of the Board's role in

the development and monitoring of the Company's long-term strategic plan.

Specifically, the disclosure should include the following: (1) A description of

the Company's corporate strategy development process, including timelines; (2)

an outline of the specific tasks performed by the Board in the strategy

development and the compliance monitoring processes, and (3) a description of

the mechanisms in place to ensure director access to pertinent information for

informed director participation in the strategy development and monitoring

processes. This disclosure of the Board's role in the strategy development

process should be disseminated to shareowners through appropriate means,

whether it be posted on the Company's website or sent via a written

communication to shareowners.

Statement of Support

The development of a well-conceived corporate strategy is critical to the

long-term success of a corporation. While senior management of our Company is

primarily responsible for development of the Company's strategic plans, in

today's fast-changing environment it is more important than ever that the Board

engage actively and continuously in strategic planning and the ongoing

assessment of business opportunities and risks. It is vitally important that

the individual members of the Board, and the Board as an entity, participate

directly and meaningfully in the development and continued assessment of our

Company's strategic plan.

A recent report by PricewaterhouseCoopers entitled "Corporate Governance and

the Board - What Works Best" examined the issue of director involvement in

corporate strategy development. The Corporate Governance Report found that

chief executives consistently rank strategy as one of their top issues, while a

poll of directors showed that board contributions to the strategic planning

process are lacking. It states: "Indeed, it is the area most needing

improvement. Effective boards play a critical role in the development process,

by both ensuring a sound strategic planning process and scrutinizing the plan

itself with the rigor required to determine whether it deserves endorsement."

8

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 5 continued

The Company's proxy statement, and corporate proxy statements generally,

provides biographical and professional background information on each director,

indicates his or her compensation, term of office, and board committee

responsibilities. While this information is helpful in assessing the general

capabilities of individual directors, it provides shareholders no insight into

how the directors, individually and as a team, participate in the critically

important task of developing the Company's operating strategy. And while there

is no one best process for board involvement in the strategy development and

monitoring processes, shareholder disclosure on the Board's role in strategy

development would provide shareholders information with which to better assess

the performance of the board in formulating corporate strategy. Further, it

would help to promote "best practices" in the area of meaningful board of

director involvement in strategy development.

We urge your support for this important corporate governance reform.

Opposing Statement of the Board of Directors

The Board of Directors believes that this proposal is contrary to the best

interests of Duke Energy and the shareholders.

The Board of Directors annually reviews management's long-term strategic plan

and reviews strategic updates. It also reviews management's specific goals at

the beginning of the year and actual performance periodically. These duties are

consistent with Duke Energy's board governance principles, and the Board of

Directors fully recognizes the importance of these obligations. The Corporate

Performance Review Committee of the Board of Directors is responsible for

assessing the implementation of strategy by business unit or function.

The Board of Directors believes that no useful purpose would be served by

providing the shareholders with a detailed description of the role of the Board

of Directors in the development and monitoring of Duke Energy's long-term

strategic plan, as requested by the proposal.

A detailed description of the role of the Board of Directors in the strategy

development process would soon become obsolete in many respects. The

opportunities that appear to be available for a given future time period when a

strategic plan is designed are often very different from the opportunities that

actually materialize. Further, variances from a strategic plan typically

develop as performances are realized. For these reasons, the Board of Directors

evaluates Duke Energy's strategic plan and management's actual performance in

achieving Duke Energy's goals by using a dynamic process that analyzes numerous

factors and peer comparisons. Of necessity, this process changes over time.

The detailed description of Duke Energy's corporate strategy development

process, including timelines, as envisioned by the proposal, could compromise

sensitive corporate information. It thus could put Duke Energy at a competitive

disadvantage without in any way aiding the oversight function of the Board of

Directors.

Approval of the proposal would not in itself result in disclosure of the role

of the Board of Directors in the development and monitoring of Duke Energy's

long-term strategic plan. Approval by the shareholders would only serve to urge

the Board of Directors to provide the requested information. Disclosure would

actually occur only after the Board of Directors exercises its collective

business judgment in determining that making the disclosure would be in the

best interests of Duke Energy and the shareholders.

The Board of Directors recommends a vote AGAINST this proposal for the reasons

set forth above.

PROPOSAL 6:

Appointment of Independent Auditors Who Only Render Audit Services

The Board of Directors recommends a vote AGAINST this shareholder proposal.

RESOLVED: That the shareholders of Duke Energy request that the Board of

Directors adopt a policy that in the future the firm that is appointed to be

the Company's independent accountants will only provide audit services to the

Company and not provide any other services.

Supporting Statement

The Securities and Exchange Commission passed new proxy statement rules that

took effect February 5, 2001, which require companies to disclose how much they

pay their accounting firms for audit services and non-audit services.

The results have been startling. According to a Wall Street Journal article of

April 10, 2001: "The nation's biggest companies last year paid far more money

than previously estimated to their independent accounting firms for services

other than auditing, newly disclosed figures show, renewing questions about

whether such fees create conflicts of interest for auditing firms... At issue:

How objective can an accounting firm be in an audit when it is also making

millions of dollars providing the client with other services."

9

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 6 continued

That Wall Street Journal article reported that of the 307 S&P 500 companies it

had surveyed, the average fees for non-audit services were nearly three times

as big as the audit fees. The Company's 2001 proxy statement revealed that it

had paid its independent auditor $3.3 million for its audit work and $11.7

million for other work.

When the SEC was seeking comments on its accountant disclosure rules,

substantial institutional investors urged that auditors should not accept

non-audit fees from companies. The California Public Employees' Retirement

System's General Counsel, Kayla J. Gillan, wrote: "The SEC should consider

simplifying its Proposal and drawing a bright-line test: no non-audit services

to an audit client." TIAA-CREF's Chairman/CEO John H. Biggs wrote:

"...independent public audit firms should not be the auditors of any company

for which they simultaneously provide other services. It's that simple."

It is respectfully submitted that it would be in the best interests of the

Company's shareholders if the Board of Directors adopts a policy that in the

future any firm appointed to be the Company's independent accountants shall

only provide audit services to the Company and not provide any other services.

Opposing Statement of the Board of Directors

The Board of Directors believes that adoption of this proposal would not be in

the best interests of Duke Energy or its shareholders.

Duke Energy is closely monitoring developments and public concerns in the area

of auditor independence and will readily comply with evolving legal and

regulatory requirements. As Deloitte & Touche LLP has announced its intention

to split its management consulting business from its audit services business,

the Board of Directors believes that this proposal is unnecessary.

As noted in the discussion under "Fees Paid to Independent Auditors" under

"Other Information" below in this proxy statement, Duke Energy has retained

Deloitte & Touche LLP to advise it on a number of matters in addition to its

core auditing functions. As set forth in that section, Duke Energy engaged

Deloitte & Touche LLP to perform various "nonaudit" services in 2001 for which

that firm billed approximately $27.6 million. This amount included $21.9

million for tax services and $5.7 million primarily for advice related to

acquisitions and divestitures and for the issuance of consents and comfort

letters in connection with SEC filings and financing transactions. These

nonaudit services are compatible with maintaining auditor independence. Indeed,

the SEC stated in its release promulgating the auditor independence rules that

"[a]ccountants will continue to be able to provide a wide variety of non-audit

services to their audit clients."

Decisions to engage a particular accounting firm are made by Duke Energy only

when two conditions are met. The first is a determination that the accounting

firm's particular expertise, coupled with its knowledge of Duke Energy and

management and financial systems, provides substantial assurance of

high-quality and timely results with tangible cost savings. The second is a

determination that the engagement is consistent with the maintenance of auditor

independence as required by the auditor independence rules of the SEC. These

determinations are reviewed regularly with the Audit Committee, as noted in the

Report of the Audit Committee.

Discretion in determining the best allocation of tasks among accounting (and

other) firms is an essential component of the ability of the Board of Directors

and the Audit Committee to discharge their responsibilities to Duke Energy and

its shareholders. The Board of Directors believes that the retention of this

discretion is entirely consistent with Duke Energy's ability to monitor and

ensure the independence of its auditors. In the area of tax services, Duke

Energy uses a number of different firms and does not rely on any firm

exclusively.

The Executive Vice President and Chief Financial Officer, the Corporate

Controller and the Audit Committee monitor and evaluate the performance of

Deloitte & Touche LLP in both its auditing services and its nonaudit services,

the magnitude of the fees paid for such services and the compatibility of the

nonaudit services with the maintenance of the firm's independence. Moreover, in

late 2000, Duke Energy adopted restrictions beyond the requirements of the

auditor independence rules of the SEC by prohibiting Deloitte & Touche LLP from

providing internal auditing services or financial information systems design

and implementation services. Duke Energy will adopt further prohibitions on

various nonaudit services as warranted by the circumstances.

In addition to these internal procedures, Duke Energy annually seeks

shareholder ratification of its selection of independent auditors. Duke Energy

also provides to its shareholders information relating to fees paid to its

auditors as well as disclosure of the Audit Committee's consideration of

whether the provision of nonaudit services is compatible with maintaining their

independence, all as required by the rules of the SEC.

10

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 6 continued

Given the recent announcement of Deloitte & Touche LLP about its consulting

business, the protective measures already in place and the disclosures required

when independent auditors are selected for nonaudit work, the Board of

Directors believes there is little chance for abuse and no benefit to Duke

Energy or its shareholders from an arbitrary limitation on the power of

management and the Board of Directors to exercise business judgment in the

selection of auditors.

The Board of Directors recommends a vote AGAINST this proposal for the reasons

set forth above.

PROPOSAL 7:

Study of the Risk and Responsibility for Public Harm Due to Duke Energy's

Nuclear Program

The Board of Directors recommends a vote AGAINST this shareholder proposal.

Nuclear Risk and Responsibility

The shareholders request the Board of Directors to conduct an open

comprehensive study, utilizing independent public resources, oversight, and

participation (but excluding proprietary and confidential information),

defining Duke Energy's risk of, and potential responsibility for, causing

public harm due to the company's continued participation in nuclear energy

programs, and to prepare, at reasonable expense, a report for the next annual

shareholders' meeting in 2003.

Supporting Statement

Duke Energy's Environmental, Health & Safety Policy states:

Duke Energy highly values the health and safety of our employees, customers

and communities.

Duke Energy will engage in partnerships that enhance public environmental,

health & safety awareness and address common environmental, health & safety

issues.

Duke Energy will foster open dialogue and informed decision making through

meaningful and regular communication of environmental, health and safety

information with management, employees and the public.

Additional Supporting Statement

The last Nuclear Regulatory Commission study of reactor accident consequences

was done by the Sandia National Laboratory in 1981.

Duke Energy has made application to the Nuclear Regulatory Commission to renew

the operating licenses for the McGuire and Catawba nuclear plants for an

additional 20 years and, if approved, will have authorization to operate these

plants until the years 2041-2046. License approval by the Nuclear Regulatory

Commission, and subsequent operation of the reactors, would extend by 20 years

the risks associated with plant aging and the threats associated with terrorism.

The Nuclear Regulatory Commission acknowledges the threat of terrorism attacks

on nuclear facilities. While ongoing analysis at the federal level is

essential, when such questions are raised at the local level, they are often

considered generic and not within the scope of the license renewal process.

Opposing Statement of the Board of Directors

The Board of Directors believes that this proposal is contrary to the best

interests of Duke Energy and the shareholders.

Duke Energy takes very seriously its responsibility to operate its nuclear

facilities safely, and it has an outstanding record in discharging its

responsibility in this regard. Duke Energy continues to be one of the top

performers in the U.S. nuclear industry in terms of regulatory safety as

indicated by reviews of the Nuclear Regulatory Commission (NRC) and the

Institute of Nuclear Power Operations.

Duke Energy conducts probabilistic risk assessments for its nuclear facilities,

which are reactor safety studies that consider the likelihood of various

accident sequences and the likely results. These studies use the most current

risk assessment methodology and the most current reliability information. Duke

Energy uses these studies to identify changes that would enable it to continue

to operate its nuclear facilities in a safe manner. These studies are shared

with various federal regulatory agencies as appropriate and are updated as

necessary.

The proposal asks that an open comprehensive study utilizing independent public

resources be undertaken and implies that a meaningful study of this kind can be

conducted and a report thereon can be issued. In fact, a meaningful study of

the sort requested by the proposal would likely be impossible to conduct and

the report that is requested by the proposal may run counter to national

security interests. This is because a substantial amount of information that is

used to develop probabilistic risk assessments for Duke Energy's nuclear

facilities is not, and never has been, available to the public. Due to

restrictions placed on the public availability of information by the NRC

following the terrorist attacks of September 11, 2001, certain information that

previously was available to the public

11

Proposals to be Voted Upon

- --------------------------------------------------------------------------------

Proposal 7 continued

has since been restricted. To the extent that the proposal requests an analysis

of vulnerabilities to terrorist attack, that analysis would require the

consideration of security-sensitive information which has never been publicly

available. Disclosure of this kind of information could raise substantial

homeland security concerns.

Duke Energy also has in place effective aging management programs for its

nuclear facilities which have been approved by the NRC. Duke Energy is

committed to implementing additional aging management programs in the context

of license renewals for those facilities as necessary to mitigate the effects

of aging during any extended periods of operation.

The Board of Directors believes that a meaningful study and report of the kind

the proposal requests, using the sources the proposal requires and conducted in

the manner the proposal specifies, cannot be generated. Such a study would also

be unnecessary since Duke Energy's analyses and assessments already address the

kinds of risks that the proposal could legitimately have the new study address.

The Board of Directors thus believes that adoption of the proposal is not in

the best interests of Duke Energy and its shareholders.

The Board of Directors recommends a vote AGAINST this proposal for the reasons

set forth above.

12

The Board of Directors

- --------------------------------------------------------------------------------

Nominees for election at the annual meeting are marked with an asterisk (*).

[PHOTO] G. Alex Bernhardt, Sr.

G. Alex Bernhardt, Sr. *

Director since 1991

Chairman and CEO, Bernhardt Furniture Company, furniture manufacturer

Age 58

Mr. Bernhardt has been associated with Bernhardt Furniture Company of Lenoir,

North Carolina, since 1965. He was named President and a director in 1976 and

became Chairman and CEO in 1996.

[PHOTO] Robert J. Brown

Robert J. Brown

Director since 1994

Chairman and CEO, B&C Associates, Inc., marketing research and public relations

firm

Age 67

Mr. Brown founded B&C Associates, Inc., High Point, North Carolina, in 1960,

served as its President from 1960 until 1968 and has been its Chairman and CEO

since 1973. He is a director of Wachovia Corporation, Sonoco Products Company

and AutoNation, Inc. He is a Class III director with a term expiring in 2003.

[PHOTO] William A. Coley

William A. Coley *

Director since 1990

Group President, Duke Power, franchised electric operations of Duke Energy

Age 58

Mr. Coley joined Duke Energy in 1966. He was named President of Duke Energy's

Associated Enterprises Group in 1994 and was appointed to his present position

in June 1997. He is a director of CT Communications, Inc. and SouthTrust

Corporation.

13

| Roger Agnelli* Director since 2004 President and Chief Executive Officer Companhia Vale do Rio Doce (CVRD), Brazil, global mining company and the world's largest producer of iron ore Age 45 Mr. Agnelli was elected President and CEO of CVRD in 2001. He served in various positions at Bradesco, a Brazilian financial conglomerate, from 1981 to 2001 and was President and CEO of Bradespar S.A. from March, 2000, to July, 2001. He is a director of Asea Brown Boveri (ABB. Ltd). | |